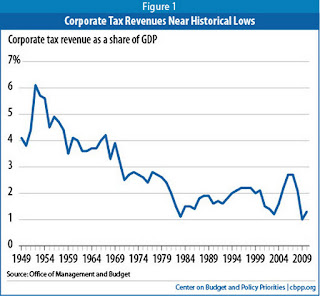

Thirty large and profitable U.S. corporations paid no income taxes in 2008 through 2010, said a study on Thursday that arrives as Congress faces rising demands for tax reform, but seems unable or unwilling to act.

Pepco Holdings, a Washington, D.C.-area power company, had the lowest effective tax rate, at negative 57.6 percent, among the 280 Fortune 500 companies studied.

The statutory U.S. corporate income tax rate is 35 percent, one of the highest in the world, but over the 2008-2010 period, very few of the companies studied paid it, said the report.

The average effective tax rate for the companies over the period was 18.5 percent, said Citizens for Tax Justice and the Institute on Taxation and Economic Policy, both think tanks.

Their report also listed General Electric Co, Paccar Inc, PG&E Corp, Computer Sciences Corp and NiSource Inc as among the 30 that paid no taxes. All 280 corporations examined were profitable over the period.

Corporations will say rightly that the loopholes that let them slash their taxes were perfectly legal, the report said.

...

______________________________________

So, in spite of what leading candidates for the presidency say, corporations do NOT pay 35% in taxes.

And every single corporation studied is making money.

They're just not hiring. They're keeping the money for themselves, getting richer and richer while the rest of the 99% suffer.

Oh, and then there is this, from the same article!

______________________________________

LOOKING BACK AT REAGAN

The report referred back to the 1986 tax reform pushed through by President Ronald Reagan, a Republican, who approved the largest corporate tax increase in U.S. history, largely by ending tax breaks, while cutting individual tax rates.

______________________________________

WTH? Reagan raised taxes? That's not what I heard from Rush Limbaugh and Sean Hannity!?!?!?!

______________________________________

"Reagan solved the problem by sweeping away corporate tax loopholes," said the report, which was co-authored by Citizens for Tax Justice chief Robert McIntyre. His research 25 years ago played a key role in convincing Reagan reform was needed.

...

http://news.yahoo.com/thirty-companies-paid-no-income-tax-2008-2010-042531293.html

No comments:

Post a Comment